January 06, 2017

First of all, Investguru Team wishes all the investors a very happy, healthy and prosperous new year 2017.

Every new year brings fresh hopes and challenges, and every gone year provides us new learning and questions the old beliefs. In this two part series, we first look back and try to highlight the various events and happenings of the year 2016, and how they shaped the last year performance of various asset classes. We shall summarise the lessons that the findings throw at us.

In the second part of the series, we shall utilise the knowledge and experience gained from the year 2016 and discuss the investment strategies for 2017. The investment strategies shall try to cover different kinds of investors with different investment needs.

Year 2016 : A Recap

The year 2016 was an uncharacteristic year in which we saw unprecedented events like Brexit, unexpected win of Donald Trump in US presidential elections, and specifically for Indians, the demonetisation of Rs. 1000 and 500 notes by the government. The three unrelated events can be termed highly critical for us due to lack of assessment as to how and upto what extent they can affect both the world and the domestic Indian economy. The interest rate hike by US Fed at fag end of the year added to the year long volatility in debt and stock markets around the world.

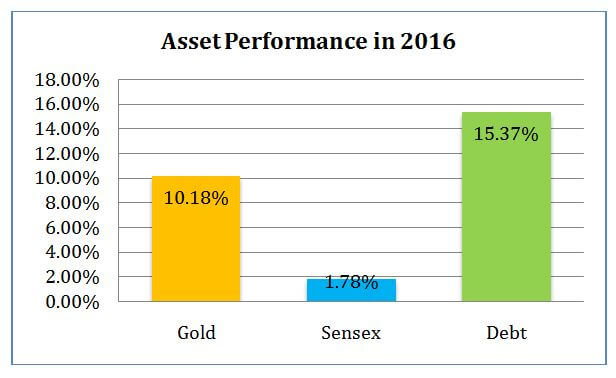

The performance of various asset classes in 2016 was as follows:

Debt

On the back of falling interest rates in 2016, the best performing asset class was Gilt which delivered 15.37% returns. The short term and medium term debt too delivered 11-12% returns. The attractive performance of debt in such a volatile market reminded us the importance of having a part of one’s portfolio in debt for stability and reasonable returns.

Equity

Sticking to its true nature, equity market remained volatile throughout the year 2016. The BSE Sensex began the year with 26160.90, touched a low of 22976 on 25th February, recovered to 28000 again on 25th July and remained sideways till first week of November. As news of Donald Trump win and demonetisation rolled, the sensex saw a downward movement till last week of December. A last moment recovery lifted the sensex and it closed the year at 26626.46, a gain of 1.78% over last year.

The roller coaster ride of stock market highlighted its uncertain behaviour and reminded investors to not speculate in stocks for short term gains. It also taught again that use of borrowings/leverage to invest and gain from stocks can prove to be very costly.

Gold

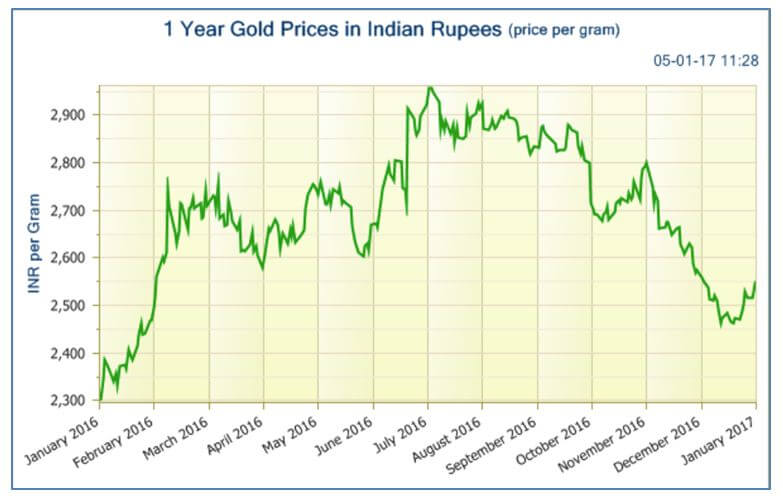

Gold, which is considered to be a safe investment, remained highly volatile throughout the year and questioned the old belief of being a safe investment. It rose from Rs. 24910 (per 10 gms) on 1st January 2016 to Rs. 32336 on 6th July 2016 and then dropped to Rs. 26,888 on 22nd December. The prices fluctuated 10-15% frequently in either direction, making the investors wonder if it really was a safe asset to invest. Despite the volatility, gold managed to deliver 10.18% returns over the calendar year.

Real Estate

The real estate investments turned illiquid as overall demand slumped. The unsold inventory of developers across India is rising, putting pressure on the appreciation of existing assets. Barring few cities like Bangalore and Ahmedabad, cities like Delhi NCR, Mumbai and Pune witnessed correction of prices. Investors who were hoping to encash their real estate holdings to utilise funds for their needs or to invest in financial assets, were left in lurch. Investors across India are realising the pain of having bulk of their savings locked in real estate which is neither giving them adequate monthly rental income nor capital appreciation.

The Lessons:

1. Debt funds provide stability and predictable returns in an uncertain market. They can deliver returns HIGHER than the equity funds in adverse market conditions.

2. Unexpected events, as the name suggests, can’t be predicted even by the so called ‘Experts’. They can occur anytime and adversely affect the stock market. Hence, short term funds should not be invested in equities, and borrowing money to invest in stocks is a bad idea.

3. Investing in gold does not mean safe investment. The investment may give negative returns and erode the capital, even to a tune of 10-20% over a short period.

4. Real estate investments are not liquid in nature, and one should not rely on these investments to meet financial goals. Specially in down market scenario, selling a real estate can become a huge challenge.

Conclusion:

Different asset classes perform differently every year. No asset class can give HIGHEST return year after year. It is prudent to allocate funds to various asset classes to benefit from their varying nature and performance. Allocation to assets should also be done on the basis of their liquid/illiquid nature depending upon one’s need of funds.

To understand how much and where to invest, we shall discuss the investment strategies for the year 2017 in our next blog.

Do share your views, suggestions and queries on the above with us. We shall be glad to hear from you.

Happy Investing!

Pawan Agrawal is the founder and managing partner of Investguru. You may reach him at pawan@investguru.in .