June 02, 2020

Stock market valuations and currency(Indian Rupee) movement against the US dollar are two critical factors that define the health of our economy at a given point of time. It is no coincidence then that the Indian stock market and currency valuation seem to move in tandem to each other in line with economic growth.

When the economy is growing, the corporate profitability is strong, stock markets are up, FII inflows are positive and the currency strengthens.

On the other hand, during slow economic growth period, the Indian stock markets go downwards and at the same time, the INR depreciates. A bad economic phase sees significant foreign investments outflows which further weakens the rupee and the stock markets.

Till now, when the economy is doing poorly, the equity investors in India have not been able to take benefit from falling rupee and also have seen their investments lose value due to stock market downsides.

However, the good news is that there are options now available to invest in International markets in dollar terms, which not only offer attractive investment opportunity but also provide benefit from rupee depreciation. The International Equity Funds in India have opened a new paradigm for Indian investors to invest in the global equity markets, especially in US which is the largest market in the world.

Top global companies like Amazon, Apple, Google, Facebook, Netflix, Starbucks are listed on US Stock Exchange. By investing in funds which invest in these kind of companies, an Indian investor can take triple benefits of investing in very large, profitable and highly innovative companies, geographical diversification of portfolio and Indian Rupee depreciation against US Dollar.

By allocating a part of his equity investments in US based equity funds, an investor can counter the downside of his Indian equity portfolio. This happens because as the rupee depreciates, the value of international investments grows in rupee terms.

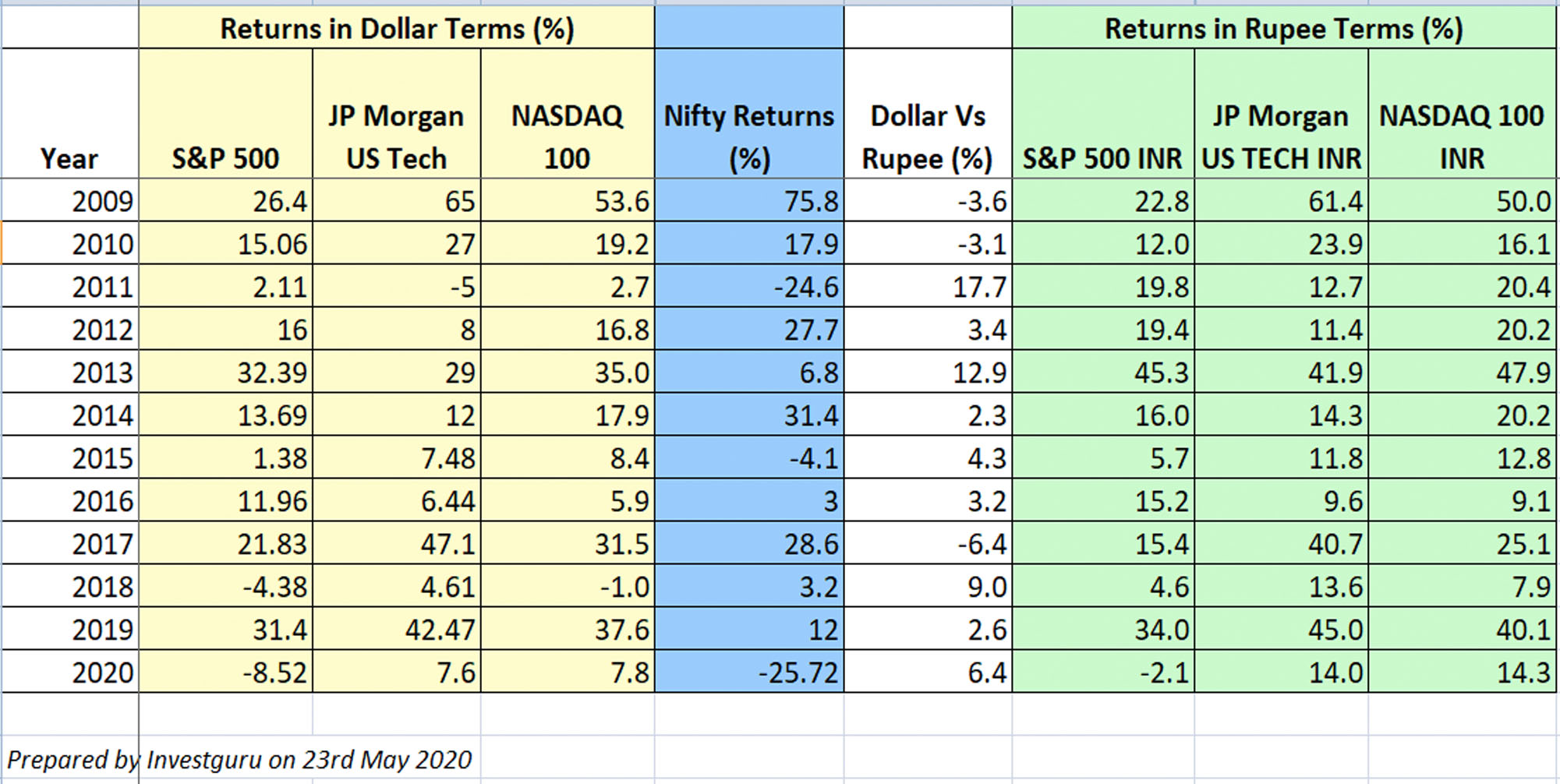

The table given below outlines the calendar year performance of Indian and US stock markets and also shows the dollar appreciation against the rupee. It also reflects on returns on US investments in rupee terms.

* Nasdaq 100 is a stock market index made up of 103 equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock market. it is one of the three most-followed indices in US stock markets.

** JP Morgan US Tech Fund- It is an equity fund which invests primarily in US Technology companies with strong fundamentals.

** S&P 500 is a stock market index that measures the stock performance of largest 500 companies listed on stock exchanges in the United States.

It can be observed that in years (such as 2011, 2013, 2015, 2018) in which Nifty 50 has given very low or negative returns, USD has appreciated (or INR has depreciated) significantly.

We can also see that in certain years like 2011, 2015, 2018, the US market had not performed well. But in those years USD has appreciated significantly against the Indian rupee. This has resulted in meaningful returns on US investments in comparison to Nifty, when converted into Indian Rupees.

Two kinds of funds are available which provide international exposure. One which invest fully in international equities and other ones are funds which invest partial amount in international equities and major amount in Indian equities. The taxation in these two kinds of funds are different, so an investor should choose the funds accordingly.

Conclusion:

As Indian equity markets provide the investors option to create wealth over long term, the top global companies also offer attractive option for growth. At times, Indian markets may not do well, hence global diversification of investment can cushion some downside. In adverse times, the international investment in dollar terms helps to regain some lost value due to our currency depreciation.

Overall, a mix of Indian and international equities helps to reduce the volatility of the portfolio and also creates signification upside for the investors.

Earlier, the options to invest in global markets in dollar terms were far and few for individual investors. Now, with many Indian mutual funds available that invests in International equities, the options are many and the process is simple.

It is prudent for an investor to explore these options and create a low volatility, all weather, high growth portfolio by investing in opportunities that are available not only in India, but across the world.

As always, your views and feedback on the above are welcome.

Happy Investing!

Tulika Agarwal

Co-Founder, Investguru