Mar 09, 2023

In a progressive country like India, parents want to provide their children the best education, whether in India or abroad. However, due to continuous advancements in education system, these aspirations come at a huge cost. The cost of a child’s graduation in India starts from lakhs of rupees and goes up to crores outside India. Hence, Child Education becomes a critical goal for parents to plan for.

Investors are aware of this fact, and they keep accumulating the money for this purpose through various savings products. Some common savings products preferred by the investors are Sukanya Samriddhi Yojana (for girl child), fixed deposits, recurring deposits and life insurance policies. Some investors also invest in PPF and real estate for this goal. These options are helpful in accumulating money for safer returns, but they lack in providing solution to various needs that arise with relation to Child Education.

Let’s see what are the various challenges of Child Education Planning and why Mutual Funds score over other investment options for Child education planning.

-

Investment Growth

The cost of education is rising rapidly with an estimated inflation rate of 6-8%. Overseas education planning also need to factor 3-4% currency depreciation. Combine these two and an international education may inflate by 8-12% per annum.

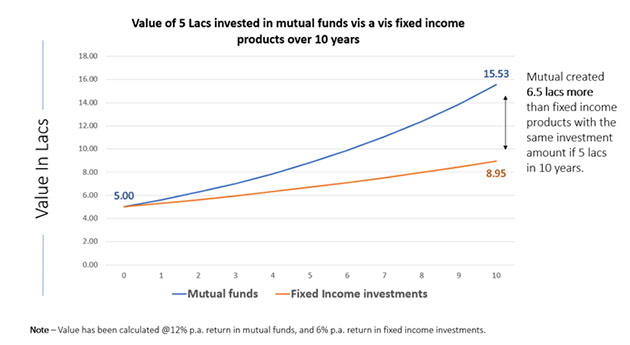

Since the cost of education goes higher drastically, the most prominent reason to choose mutual funds over other investment products is growth of invested money. Growth oriented Mutual Funds are able to generate 10-15% annualized returns over long-term, while other investment products like FDs, RDs, Sukanya Samriddhi account are able to provide 5-8% rate of interest per annum.

This difference in rate of return of around 5-7% per annum between growth mutual funds and safer investment options creates a huge difference in maturity/final fund value over a long period. The higher fund value helps in meeting large ticket goals, especially if money available for investment is limited.

To understand the difference, let’s suppose, an investor Mr. A’s child’s graduation is due after 10 years, and costs 10 lakhs today. At an inflation rate of 7% per annum, it will cost around 20 lakhs after 10 years. A has 5 lacs available with him which he can invest for his child graduation due after 10 years.

As shown in the graph above, if he invests these 5 lacs in a fixed income product providing post-tax interest of 6% p.a, it will grow to around 9 lakhs after 10 years, which is equivalent only to half of the corpus required. On the other hand, if he invests these 5 Lacs in mutual funds generating an average post-tax return of 12% p.a, it will grow to 15.5 lakhs which is very close to the total requirement for graduation goal of the child. Simply said, the incremental returns earned by investing in growth mutual funds can help to fund at least 1-2 more years of education cost of a child.

It is worth noting that growth in mutual funds comes with volatility and risk whereas FDs and recurring deposits are safe options. However, if an investor has a long-time horizon of 5 years and more and limited money to invest, growth mutual funds option should be considered. -

Tax Saving

Like other investment options, mutual funds also allow investment in the name of a minor child. Investing in child’s name becomes tax efficient when the child becomes an adult.

While investing when the child in minor, the interest earned on products like FDs, RDs, NSCs etc. are clubbed with the income of the guardian and are taxed in the same financial year it is earned. On the contrary, gains on mutual funds are taxed only at the time of redemption which is expected at the time of higher education of the child. Till then, child attains majority and gains are taxed in his own name and are not clubbed with the income of the guardian. Since, children generally do not have any other income when they attain majority, the gains attract nil or lower tax liability.

So, through mutual funds, an investor can plan for Child Education fund by investing in child’s name and can also reduce current tax liability.

-

Flexible Withdrawals

Withdrawals from the amount accumulated for Child’s education are required at different times for different purposes. For example, college fees are generally paid semester wise, accommodation and regular expenses of a child are paid monthly.

Traditional products like FDs, RDs, moneyback policies pay the whole maturity amount to the investor in one shot. The investor keeps this amount in savings bank account and remains anxious that the amount does not get spent elsewhere.

On the contrary, mutual funds provide absolute flexibility to the investors to withdraw the required amount as and when needed. They are not bound to take out all the investments in their savings bank account at once. The corpus remaining after withdrawals stays invested and keeps generating returns. Investors can also generate regular income from mutual funds through SWP (Systematic withdrawal plan) to fund regular expenses of the child.

-

Flexible Duration of Investment

Majority of the investment products have a fixed maturity date for the investments. This date generally does not exactly match with the due date for the child’s higher education.

For example, an investor’s child’s graduation is due after 6 years, but he has an option to put 10 lacs today in a 5-year FD or a 10-year FD for the goal. Now, if he chooses the 5-year FD, he will end up keeping money idle for last 1 year. If he chooses the 10-year FD, he will have to pay penalties for premature withdrawal. This is the case with majority of the investment options.However, in growth mutual funds, there is no maturity date. The investor can invest the money exactly for the time available for the goal. Investors can also adjust the duration of the investments. If, suppose, one accumulates money for 5 years for his child’s graduation but due to some reason, graduation gets delayed by 1 year. He can, in this case, choose to keep the investments for 1 more year, hence taking the duration of the investment from 5 years to 6 years. Similarly, suppose, if the amount is required earlier than the due date of graduation, then the investor can withdraw it, reducing its duration from 5 years to lesser.

So, maturity date in mutual funds is set by the investor according to his own need and goals.

-

Invest any amount, anytime!

Child education is a big-ticket long-term goal. It generally takes a large chunk of an investor’s investment allocation. As earnings of an investor varies over time, he needs a flexible option to invest any amount, whenever available.

Traditional investment options do not provide much flexibility in this regard. For example – Sukanya Samriddhi account allows investment only in the name of girl child for maximum amount of 1.5 lacs in a financial year. Fixed deposits require lumpsum investment at one ago. You cannot put additional investment in an existing FD during its tenure. These types of restrictions are common in various investment products.

However, mutual funds provide total flexibility to the investors. The investment in mutual funds can be done in lumpsum mode as well as in SIP (Systematic Investment Plan) mode. SIP can be started with as low as Rs.500/- and can go up to the amount of your choice. Additional investment can be done in a fund whenever available. This feature helps the investors to accumulate the money with convenience.

Conclusion

It is important to plan well for Children’s Education. Though one can choose any investment product to accumulate money for the purpose, yet mutual funds provide higher growth and flexibility in approach. Through mutual funds, it is possible to create a huge corpus at one place and meet rising needs of Child Education efficiently.

Wishing you prosperity with peace!

Taneesha Bansal

Research Analyst, InvestGuru