June 06, 2022

Investments in Mutual funds can be done in two ways – Lumpsum and SIP.

SIP (Systematic Investment Plan) is a method of investing a fixed sum regularly in a mutual fund scheme. Through affordable amounts invested over a period, and with capital appreciation of the investment, an investor is able to create a large fund for his future family needs.

The amount of SIP gets automatically deducted from the bank account of the investor for the period selected by him. However, there are various situations that may occur due to which an investor has to stop the ongoing SIP investment. The reasons may be - disturbance in regular income, increase in expenses, emergency needs or any other.

As the need of stopping an SIP arises, all mutual fund schemes allow the investors to stop the SIP anytime without any penalty or charges. It generally takes 30-45 days to stop an SIP from the date of request raised by the investor. Once the SIP stops, the future purchases in the scheme get stopped and no auto debit happens from the investor’s bank account. The amount already invested remains in the fund and keeps growing.

At times, the investors have the confusion about what happens to the existing fund after the SIP stops, does it make any further gains etc. The below points address various such queries -

- What does “SIP Stop” do?

When an SIP is registered, the SIP amount gets automatically deducted from the bank account of the investor on a monthly/ weekly/ yearly basis depending upon the frequency of the SIP. SIP Stop cancels this auto deduction, hence future purchases in the scheme get stopped.

-

Can a stopped SIP be restarted in future?

Yes, Once an SIP is stopped, an investor can anytime restart the SIP of same amount/ revised amount in the same scheme.

-

Does SIP Stop creates any charges or penalty on the investor?

No, There are no charges/penalty for stopping an SIP in a scheme. It is completely a free of cost facility.

-

Does SIP stop automatically redeem the invested amount also?

No, SIP stop just cancels the future auto debit from the bank account. The amount already invested remains in the scheme and keeps performing.

In case any investor wishes to redeem the invested amount also, a separate request has to be submitted with the fund house.There are few schemes which have lock-in periods for investments like Equity Linked Saving Schemes(ELSS). In such schemes, the amount equivalent to value of free units (Units which are out of lock-in period) can be redeemed by the investor when needed.

-

What happens with the already invested amount after stopping SIP?

When an SIP amount gets invested in a scheme, units are allotted to the investor. When an SIP is stopped, the units already allotted remains invested and their value keeps performing according to the securities in the scheme.

This can be understood with the following real example.

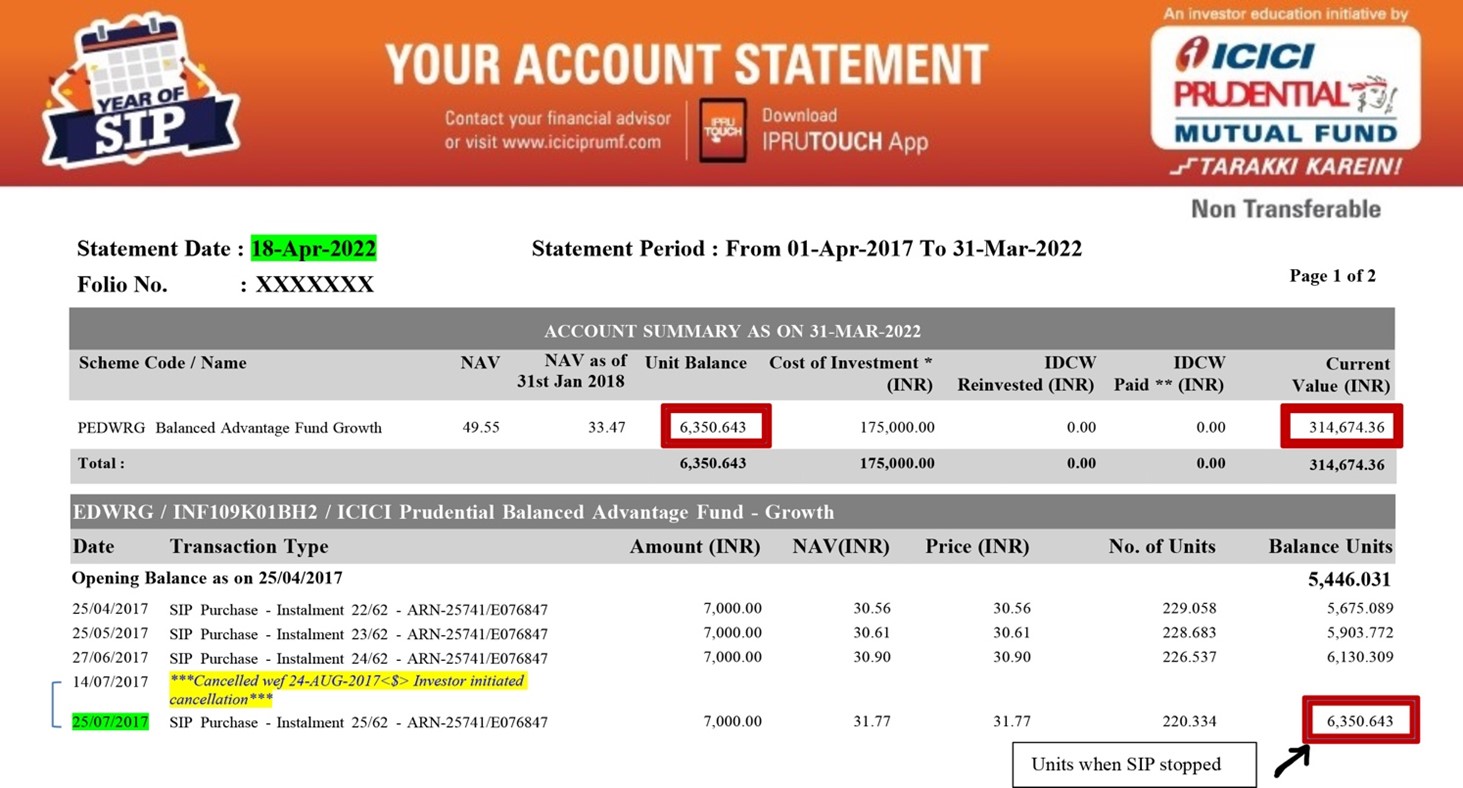

An Investor started an SIP of Rs. 7000 per month in ICICI Balanced Advantage fund in July, 2015 and stopped it in July, 2017. In this way, he invested total Rs.1,75,000 in the scheme till July 2017, against which in total 6350.643 units were allotted.

Observations from the above

- The investor was investing Rs. 7000/ month through SIP on 25th of every month.

- The investor stopped SIP on 14th July 2017, which got cancelled w.e.f. 24th Aug 2017 as highlighted. That means it took 40 days for the SIP to get stopped and the SIP instalment, which was due on 25th July 2017, got duly deducted.

- No charges/ penalty has been charged in the statement.

- The 6350.643 units allotted against investments till July 2017 remained same, as on the statement date 18th April 2022.

- The value of investment as on 18th April 2022 is Rs. 3,14,674. The existing 6350.653 Units multiplied by NAV as on the date 49.55 results into this value of 3,14,674. This means that the units remain same, but NAV of the fund keeps performing. Hence, value of the investments also keeps growing.

- The folio is active and an amount equivalent up to value of investments can be redeemed by the investor anytime.

Points to remember

- Since SIP is a disciplined investment tool, it should be stopped when there is any liquidity crunch or financial emergency to be met.

- If an investor is required to stop SIP due to any reason, the amount already invested should not be redeemed if it is not required, as it keeps growing with time.

- While stopping an SIP, an investor should keep in mind that it would take 30-45 days for the SIP to stop. So, if there is any instalment due in between the dates, SIP amount should be kept available in the bank account.

Conclusion

Stopping an SIP is an action taken to stop future investment in a scheme. This facility is a tool designed to give the investors freedom to stop their investment in case of any liquidity crunch or any financial reason. It does not create any penalty on the investor. The invested amount keeps performing according to the performance of the securities in the scheme and can be redeemed by the investor as and when required.

Wishing you prosperity with peace!

Taneesha Bansal

Research Analyst, InvestGuru